Bagged graphite from Syrah Resources' Balama project in Mozambique. In July, the U.S. Department of Energy finalized a $102.1 million loan to the mining company for its graphite plant in Vidalia, La.

Source: Syrah Resources Ltd.

The U.S. Department of Energy, newly equipped with $250 billion to lend to projects that repurpose or convert existing energy infrastructure, is now figuring out how to advertise the program to the communities that need it the most.

"I would say the biggest challenge that we have, honestly, is that for many of these communities, they haven't thought about how to build a project," Jigar Shah, director of the DOE Loan Programs Office, told S&P Global Commodity Insights. "That's the hard part, is starting that process."

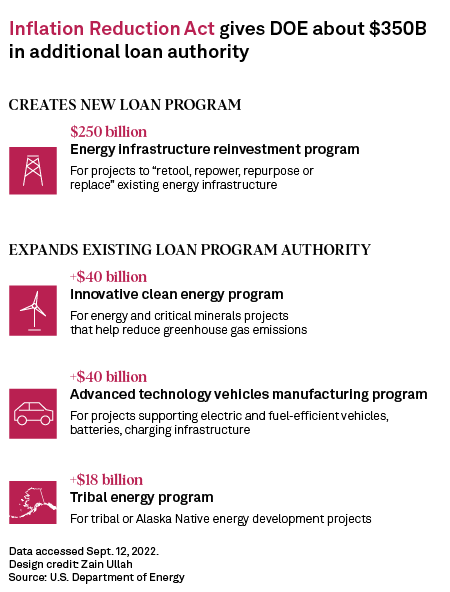

The Inflation Reduction Act, or IRA, signed by U.S. President Joe Biden in August, authorized $369 billion in climate and energy spending, with its bundle of tax credits receiving top billing. But the law also authorized nearly as much in new DOE loan authority — about $350 billion — as it did in overall spending.

The DOE Loan Programs Office, created by the Energy Policy Act of 2005, has provided about $36 billion in debt financing to commercial energy and advanced vehicle manufacturing projects. However, while previous loans prioritized innovation, Congress's latest authorization focuses on reuse.

The IRA appropriated $11.7 billion to the loans office, for credit subsidies and administrative costs, and added about $100 billion in lending authority to DOE's existing loan programs. But the act also created a new Energy Infrastructure Reinvestment program, authorizing DOE to lend up to $250 billion to projects making use of existing energy assets.

"Some of the projects that would be in that definition are really straightforward — things like converting a coal plant to a nuclear plant, or a renewable energy and battery storage facility, or a natural gas facility," said Shah.

Other projects may invest in midstream infrastructure, repurposing natural gas pipelines for new energy ventures like hydrogen fuel or carbon capture and storage. These technologies, poised to benefit from IRA, require pipelines to transport ammonia and carbon dioxide, respectively.

"We've had a couple of folks reach out to us and say, 'We want to convert that pipeline into a CO2 pipeline or an ammonia pipeline,'" said Shah, who joined the Biden administration from Generate Capital PBC, which invests in energy infrastructure.

As the U.S. moves away from coal-powered electricity, retired coal plant sites still retain value from their grid connection and former workforce. Vistra Corp., supported by Illinois's "Coal to Solar" initiative, committed in 2021 to building six solar-and-storage and three standalone energy storage facilities in that state.

Fortescue Future Industries Pty. Ltd. is also weighing reinvestment in a former coal mine in Centralia, Wash., where the Australian developer plans to build a green hydrogen production facility.

The broadly defined Energy Infrastructure Reinvestment program does not specify whether the conversion of old mine sites would be eligible for a loan. In addition to projects to turn gasoline stations into electric vehicle charging facilities, such "edge cases" will be taken into consideration over the next several months as the DOE prepares its guidance for the program, Shah said.

DOE bets on ambition

Shah has described the Loan Programs Office as a way for the DOE to step in when the "commercial banks are too shy." In the past, this has included nascent technologies deemed too risky by commercial lenders.

Many of those bets have paid off, such as a $465 million loan in 2010 to what was then Tesla Motors, now Tesla Inc. The loans office soon lost momentum, however, after being lambasted by Republican lawmakers for the collapse of Solyndra. The solar company declared bankruptcy after it had received $535 million in federal loans.

The Biden administration has since made reviving the program a priority. In June, the DOE closed a $504.4 million loan guarantee to a green hydrogen storage project in Utah. The announcement was followed in July by another DOE loan guarantee of $102.1 million to a graphite mining company to process the battery mineral.

Unlike previous loan programs, the Energy Infrastructure Reinvestment program does not require projects to be innovative. But projects may have other attributes that prevent them from securing mainstream financing.

"There's a lot of solar developers that are trying to buy up coal plants and convert them to solar plus battery storage," Shah said. The problem, he said, is getting ESG-conscious financiers to fund the first transaction. "Many of these financiers don't want to own a coal plant, even if it's only for a week."

However, financing is not the only barrier to energy infrastructure deployment. The DOE, in a study released Sept. 13, found that hundreds of U.S. coal plant sites could be converted to nuclear, potentially increasing nuclear fleet capacity to more than 350 GW.

"For some of these coal plants, the best use case for them is to be converted into nuclear plants," Shah said. "But as you can imagine, getting a public service commission to agree to a nuclear plant is not an easy process."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.